InsurTech (Insurance Technology): How Tech is Transforming Insurance

7 min read

10 Oct 2025

InsurTech, a blend of insurance and technology, is revolutionizing the insurance industry by leveraging innovative technologies to enhance efficiency, customer experience, and risk management. This article explores the impact of InsurTech on insurance processes and customer interactions.

Understanding InsurTech

Definition and Scope: InsurTech refers to the use of technology to create new insurance products, improve underwriting and claims processes, and enhance customer engagement.

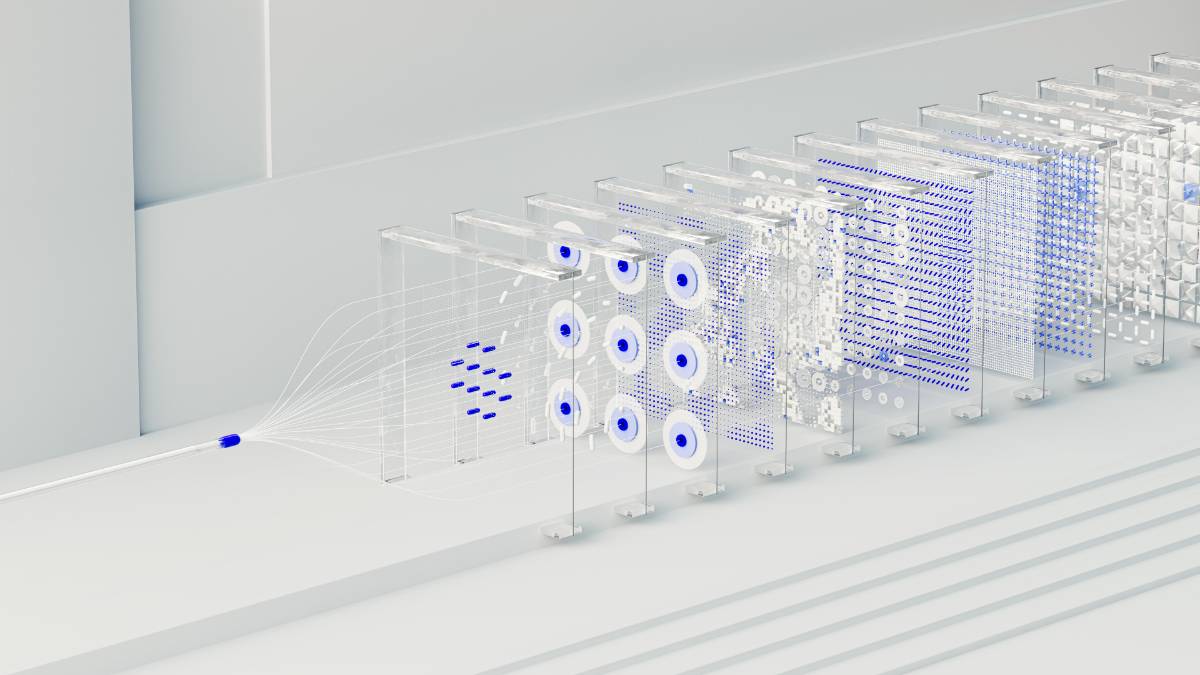

Key Technologies: AI, machine learning, IoT, blockchain, and big data analytics are pivotal in transforming insurance operations and customer interactions.

Digital Transformation: Insurers are embracing digital platforms to streamline operations, reduce costs, and offer personalized insurance solutions.

Benefits of InsurTech

Improved Customer Experience: Enhances policy management, claims processing, and customer support through digital channels and self-service options.

Enhanced Risk Assessment: AI and data analytics enable insurers to assess risks more accurately and customize insurance policies based on individual behaviors and needs.

Operational Efficiency: Automates manual processes, reduces paperwork, and accelerates claims processing, leading to cost savings and faster service delivery.

Challenges and Opportunities

Regulatory Compliance: Adapting to evolving regulatory requirements while integrating new technologies and data privacy measures.

Cybersecurity Risks: Protecting sensitive customer data and ensuring secure transactions amidst increasing cyber threats.

Market Competition: Balancing innovation with traditional insurance practices and adapting to changing consumer expectations and competitive pressures.

Future Trends in InsurTech

Personalized Insurance Products: Further customization of insurance products based on real-time data and customer preferences.

IoT and Telematics: Integration of IoT devices to monitor risks in real-time and offer usage-based insurance.

AI-driven Claims Processing: Automation of claims assessment and settlement using AI algorithms for faster and more accurate outcomes.

Conclusion

InsurTech continues to reshape the insurance landscape, offering insurers opportunities to innovate, improve operational efficiencies, and deliver superior customer experiences. As technology evolves and consumer demands shift, the future of InsurTech holds promise for more personalized, efficient, and responsive insurance services.

The AR Breakthrough That Will Make Blockchain Transactions Simpler Than Ever!

5 min read | 15 Nov 2025

How AI Is Making Blockchain Smarter and Safer – The Inside Scoop!

6 min read | 14 Nov 2025

The Big Tech Twist: How VR Is Set to Disrupt Blockchain Like Never Before!

6 min read | 13 Nov 2025

Unlocking the Power of AR: How Augmented Reality Is Set to Revolutionize Blockchain!

6 min read | 12 Nov 2025More Articles

The Intersection of AI and IoT: Smart Homes and Connected Devices

4 min read | 10 Oct 2025

AI in Agriculture: Precision Farming and Sustainable Practices

5 min read | 09 Oct 2025

Machine Learning Algorithms: An Overview of Popular Techniques and Their Applications

6 min read | 08 Oct 2025

AI and the Creative Arts: Exploring Machine Generated Music and Art

6 min read | 07 Oct 2025

More Articles

The Ethical Dilemmas of Artificial Intelligence: What We Need to Know

6 min read | 09 Nov 2025

AI-Powered Personal Assistants: Are They Changing How We Work?

4 min read | 08 Nov 2025

Machine Learning in Cybersecurity: Protecting Data in a Digital World

4 min read | 07 Nov 2025

The Rise of AI in Creative Industries: Can Machines Be Truly Creative?

6 min read | 06 Nov 2025